Seres Therapeutics Reports First Quarter Financial Results and Provides Operational Updates

– Preclinical data provide mechanistic insights related to the potency of microbiome therapeutics to augment immuno-oncology treatments; initiation of clinical study in metastatic melanoma planned for later this year –

– FDA dialogue ongoing to support development of SER-287 for Ulcerative Colitis; Company plans to initiate clinical trial in mid-2018 –

– Company to host Microbiome R&D Day on May 24 in New York City –

– Conference call at 8:30 a.m. ET today –

CAMBRIDGE, Mass.--(BUSINESS WIRE)--May 9, 2018-- Seres Therapeutics, Inc. (Nasdaq:MCRB), today reported first quarter financial results and provided operational updates.

Roger J. Pomerantz, M.D., President, CEO and Chairman of Seres commented: “Seres has made significant progress in advancing our field-leading microbiome therapeutic pipeline. We continue to enroll the SER-109 Phase 3 study in patients with multiply recurrent C. difficile infection. We have had positive dialogues with FDA to support further development of SER-287 in Ulcerative Colitis and we continue to plan to initiate a next SER-287 study in mid-2018. Seres also presented important preclinical data that further elucidate how microbiome therapy impacts immune biology and checkpoint inhibitor activity. Dialogue with the FDA is ongoing regarding immuno-oncology related development plans, and we expect initiation of the SER-401 microbiome therapy clinical study later this year.”

Recent Highlights

- FDA feedback obtained regarding further development of SER-287: The FDA recently provided positive feedback on proposed further development activity for SER-287. Seres intends to finalize its plans for further SER-287 development and expects to initiate an induction study in patients with active mild-to-moderate Ulcerative Colitis in mid-2018.

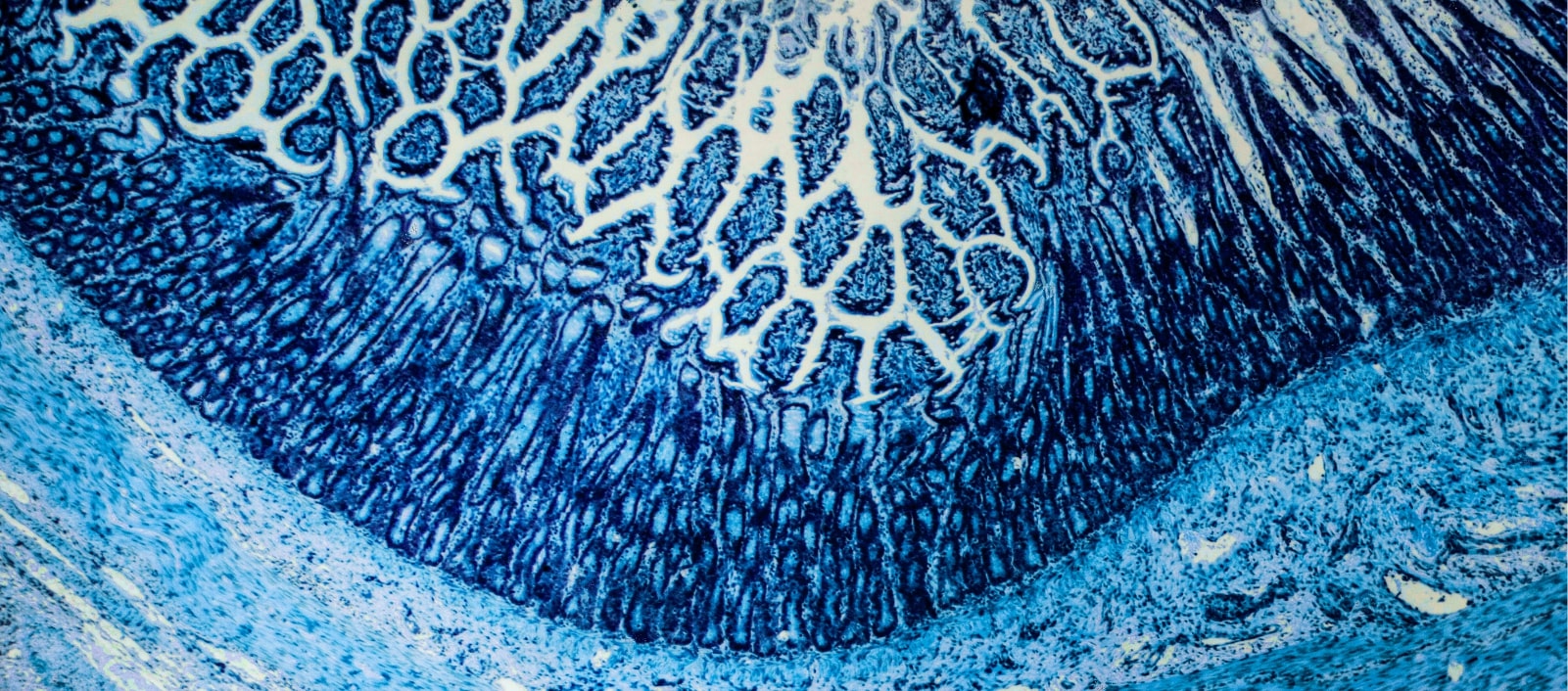

Seres previously reported positive results from a SER-287 Phase 1b placebo-controlled induction study in 58 patients with mild-to-moderate Ulcerative Colitis who were failing current therapies. SER-287 administration resulted in a dose-dependent improvement of both clinical remission rates and endoscopic scores. High clinical response rates were observed in the placebo arm and were not statistically differentiated from the SER-287 treatment arms. The SER-287 safety and tolerability profile was favorable with no imbalance in adverse events in patients treated with SER-287, as compared to placebo. Analyses of study microbiome data demonstrated that SER-287 induced dose-dependent engraftment of SER-287-derived bacterial species.

- Continued execution of the SER-109 ECOSPOR III Phase 3 study: Seres continues to enroll its SER-109 Phase 3 clinical study in patients with multiply recurrent C. difficile infection, at sites in both the U.S. and Canada. Based on previously disclosed interactions with the FDA, ECOSPOR III has been designated a Phase 3 trial and the Company expects that this single pivotal study could support SER-109 registration and approval. SER-109 has been designated by the FDA as a Breakthrough Therapy and has been given Orphan Drug Designation.

- New microbiome immuno-oncology preclinical data: Seres presentedfoundational, preclinical data at the 2018 Annual Meeting of the American Association for Cancer Research which provide mechanistic insights on the microbiome’s role in checkpoint inhibitor efficacy in cancer tumor models. In collaboration with the Parker Institute for Immunotherapy and MD Anderson Cancer Center, Seres expects to initiate a clinical study later this year to evaluate the potential for SER-401, a microbiome therapy, to augment checkpoint inhibitor response in patients with metastatic melanoma.

- SER-262 preliminary Phase 1b study results: Seres previously reported that it obtained preliminary clinical and microbiome results from the SER-262 Phase 1b, first-in-human, dose-escalation clinical study of SER-262 in patients with primary C. difficile infection. SER-262 is the first rationally-designed, fermented microbiome therapeutic candidate ever evaluated in patients. Of note, a low C. difficile recurrence rate was observed in patients treated with Vancomycin and SER-262, as compared to those treated with Metronidazole and SER-262 (4% versus 31%, respectively). This difference was statistically significant with a p value of 0.0049. Phase 1b microbiome data suggest that treatment with Vancomycin, followed by SER-262, results in more robust and kinetically more rapid engraftment, and thus may lead to corresponding clinical efficacy. Clinical, microbiome and metabolomic analyses remain ongoing. The proprietary SER-262 human data sets obtained will be used to inform future development of SER-262 and other fermented Seres therapeutic candidates, including SER-301 for Inflammatory bowel disease.

Financial Results

Seres reported a net loss of $27.9 million for the first quarter of 2018, as compared to a net loss of $25.5 million from the first quarter of 2017. The first quarter net loss was driven primarily by clinical and development expenses, personnel expenses, and ongoing development of the Company’s microbiome therapeutics platform. The first quarter net loss figure was inclusive of $4 million in recognized revenue primarily associated with the Company’s collaboration with Nestlé Health Science.

Research and development expenses for the first quarter 2018 were $23.5 million, as compared to $20.1 million for the same period in 2017. The research and development expense was primarily related to Seres’ microbiome therapeutics platform, the clinical development of SER-109, SER-262 and SER-287, as well as the Company’s immuno-oncology preclinical programs.

General and administrative expenses for the fourth quarter were $8.8 million, as compared to $8.8 million for the same period in the prior year. General and administrative expenses were primarily due to headcount, professional fees and facility costs.

The decrease in the Company’s cash, cash equivalents and investments balance during the quarter was $27.8 million. Seres ended the fourth quarter with approximately $122.2 million in cash, cash equivalents and investments.

Financial Expectations

Based on the Company’s current operating plan, cash resources are expected to fund operating expenses and capital expenditure requirements, excluding net cash flows from future business development activities or potential incoming milestone payments, for at least the next 12 months.

Seres is eligible to receive a substantial milestone payment, not considered in the financial guidance update, associated with the planned initiation of the next SER-287 clinical study.

Upcoming Microbiome R&D Day

Seres plans to host a webcast R&D day at 8:30 a.m. ET on May 24 in New York City. The event will focus on the opportunity for microbiome therapeutics to impact immune biology and will feature Seres scientists and clinicians, as well as external academic subject matter experts.

Conference Call Information

Seres’ management will host a conference call today, May 9, 2018, at 8:30 a.m. ET. To access the conference call, please dial (844) 277-9450 (domestic) or (336) 525-7139 (international) and reference the conference ID number 1599207. An updated corporate presentation will be made available on the Seres website prior to the call. To join the live webcast, please visit the “Investors and Media” section of the Seres website at www.serestherapeutics.com.

A webcast replay will be available on the Seres website beginning approximately two hours after the event and will be archived for approximately 21 days.

About Seres Therapeutics

Seres Therapeutics, Inc., (Nasdaq:MCRB) is a leading microbiome therapeutics platform company developing a novel class of biological drugs that are designed to treat disease by restoring the function of a dysbiotic microbiome, where the state of bacterial diversity and function is imbalanced. Seres’ lead program, SER-109, has obtained Breakthrough Therapy and Orphan Drug designations from the U.S. Food and Drug Administration and is in Phase 3 development for multiply recurrent C. difficile infection. Seres’ clinical candidate SER-287 has successfully completed a Phase 1b study in patients with mild-to-moderate Ulcerative Colitis. Seres is also evaluating SER-262, a rationally-designed microbiome therapeutic candidate, in a Phase 1b study in patients with primary C. difficile infection. Seres is developing SER-401 to impact the immune response and increase the efficacy of checkpoint inhibitors used in cancer treatment. For more information, please visit www.serestherapeutics.com. Follow us on Twitter @SeresTx.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including our development plans, the ability of ECOSPOR III to support SER-109 approval, the promise and potential impact of any of our microbiome therapeutics or clinical trial data, timing of and plans to initiate clinical studies of SER-287 and SER-401, the timing and results of any clinical studies, and the sufficiency of cash to fund operations.

These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: we have incurred significant losses, are not currently profitable and may never become profitable; our need for additional funding; our limited operating history; our unproven approach to therapeutic intervention; the lengthy, expensive, and uncertain process of clinical drug development, including potential delays in regulatory approval; our reliance on third parties and collaborators to conduct our clinical trials, manufacture our product candidates, and develop and commercialize our product candidates, if approved; our lack of experience in manufacturing, selling, marketing, and distributing our product candidates; failure to compete successfully against other drug companies; protection of our proprietary technology and the confidentiality of our trade secrets; potential lawsuits for, or claims of, infringement of third-party intellectual property or challenges to the ownership of our intellectual property; our patents being found invalid or unenforceable; risks associated with international operations; our ability to retain key personnel and to manage our growth; the potential volatility of our common stock; our management and principal stockholders have the ability to control or significantly influence our business; and we are currently subject to securities class action litigation. These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, on March 8, 2018 and our other reports filed with the SEC, including the Quarterly Report we intend to file later today, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

|

SERES THERAPEUTICS, INC. |

|||||||||||||

|

|

|

||||||||||||

|

March 31, |

December 31, |

||||||||||||

| Assets | |||||||||||||

| Current assets: | |||||||||||||

| Cash and cash equivalents | $ | 47,194 | $ | 36,088 | |||||||||

| Investments | 75,000 | 113,895 | |||||||||||

| Prepaid expenses and other current assets | 4,260 | 5,095 | |||||||||||

| Total current assets | 126,454 | 155,078 | |||||||||||

| Property and equipment, net | 31,466 | 32,931 | |||||||||||

| Restricted cash | 1,513 | 1,513 | |||||||||||

| Total assets | $ | 159,433 | $ | 189,522 | |||||||||

| Liabilities and Stockholders' Equity | |||||||||||||

| Current liabilities: | |||||||||||||

| Accounts payable | $ | 5,418 | $ | 7,033 | |||||||||

| Accrued expenses and other current liabilities | 11,873 | 12,513 | |||||||||||

| Deferred revenue - related party | 17,859 | 12,079 | |||||||||||

| Total current liabilities | 35,150 | 31,625 | |||||||||||

| Lease incentive obligation, net of current portion | 8,554 | 8,989 | |||||||||||

| Deferred rent | 2,234 | 2,233 | |||||||||||

| Deferred revenue, net of current portion - related party | 102,333 | 84,847 | |||||||||||

| Other long-term liabilities | 1,129 | 1,129 | |||||||||||

| Total liabilities | 149,400 | 128,823 | |||||||||||

| Commitments and contingencies | |||||||||||||

| Stockholders’ equity: | |||||||||||||

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized at March 31, 2018 and December 31, 2017; no shares issued and outstanding at March 31, 2018 and December 31, 2017 |

— | — | |||||||||||

|

Common stock, $0.001 par value; 200,000,000 shares authorized at March 31, 2018 and December 31, 2017; 40,652,668 and 40,571,015 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively |

40 | 40 | |||||||||||

| Additional paid-in capital | 328,446 | 324,376 | |||||||||||

| Accumulated other comprehensive loss | (106 | ) | (146 | ) | |||||||||

| Accumulated deficit | (318,347 | ) | (263,571 | ) | |||||||||

| Total stockholders’ equity | 10,033 | 60,699 | |||||||||||

| Total liabilities and stockholders’ equity | $ | 159,433 | $ | 189,522 | |||||||||

|

SERES THERAPEUTICS, INC. |

|||||||||||||

| Three Months Ended March 31, | |||||||||||||

| 2018 | 2017 | ||||||||||||

| Revenue: | |||||||||||||

| Collaboration revenue - related party | $ | 3,766 | $ | 3,015 | |||||||||

| Grant revenue | 205 | — | |||||||||||

| Total revenue | 3,971 | 3,015 | |||||||||||

| Operating expenses: | |||||||||||||

| Research and development expenses | 23,460 | 20,143 | |||||||||||

| General and administrative expenses | 8,777 | 8,762 | |||||||||||

| Total operating expenses | 32,237 | 28,905 | |||||||||||

| Loss from operations | (28,266 | ) | (25,890 | ) | |||||||||

| Other income (expense): | |||||||||||||

| Interest income (expense), net | 347 | 416 | |||||||||||

| Total other income (expense), net | 347 | 416 | |||||||||||

| Net loss | $ | (27,919 | ) | $ | (25,474 | ) | |||||||

| Net loss per share attributable to common stockholders, basic and diluted | $ | (0.69 | ) | $ | (0.63 | ) | |||||||

| Weighted average common shares outstanding, basic and diluted | 40,628,434 | 40,368,536 | |||||||||||

| Other comprehensive income (loss): | |||||||||||||

| Unrealized gain (loss) on investments, net of tax of $0 | $ | 40 | $ | (2 | ) | ||||||||

| Total other comprehensive income (loss) | 40 | (2 | ) | ||||||||||

| Comprehensive loss | $ | (27,879 | ) | $ | (25,476 | ) | |||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20180509005145/en/

Source: Seres Therapeutics, Inc.

Seres Therapeutics

Carlo Tanzi, Ph.D., 617-203-3467

Vice President, Investor Relations and Corporate Communications

ctanzi@serestherapeutics.com