Four Boston biotech firms worth watching

It’s already a banner year for biotech in Massachusetts, with 11 firms going public so far — a new record for a single year.

In the past few months I’ve been taking a look at some of the companies in the next wave of promising biotechnology in Boston. Here are the details on four of the firms that have especially caught my attention for their efforts to develop game-changing approaches to fighting disease. (Already one of them, T2 Biosystems, has progressed to filing its IPO intentions since my interview with the firm.)

Editas Medicine, Cambridge

- Sector: Gene editing

- Details: Editas has developed a way to potentially reengineer any gene in the human genome. The development holds the promise of treating any disease with a genetic underpinning. Founders of the company include Harvard’s George Church and MIT’s Feng Zhang. The company launched in November.

- Funding & investors: $43 million from Flagship Ventures, Polaris Partners, and Third Rock Ventures.

- Latest news: Appointed former Avila Therapeutics chief executive Katrine S. Bosley as its new CEO last month.

Moderna Therapeutics, Cambridge

- Sector: Messenger RNA therapeutics

- Details: Moderna is seeking to battle disease by stimulating the body to make its own treatments. Specifically, it’s using messenger RNA to stimulate protein growth — for example, stimulating regrowth of heart cells after a heart attack, or stimulating the growth of a protein that would kill cancer cells. The company has 16 research programs ongoing, eight of them with AstraZeneca and two of them with Alexion. Moderna expects several drugs using its technology will head into clinical trials between the summer of 2015 and the summer of 2016. The company was founded in 2012 within Flagship VentureLabs in Cambridge.

- Funding & investors: $540 million from Flagship Ventures, AstraZeneca, and Alexion.

- Latest news: Expanded into a new headquarters in Cambridge last month that nearly doubles its square footage.

Seres Health, Cambridge

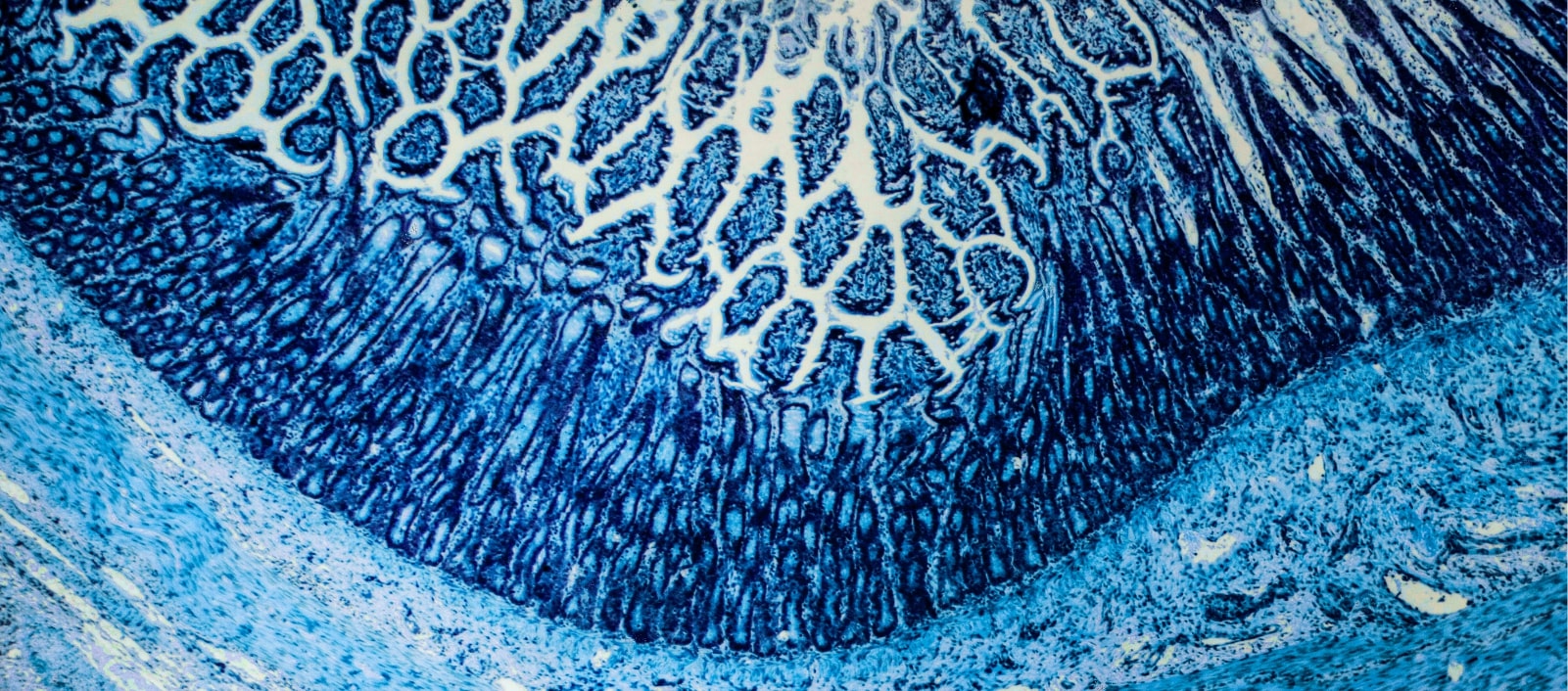

- Sector: Microbiome-based therapeutics

- Details: Seres Health is developing therapeutics that aim to change the course of illness by targeting the microorganisms that live inside humans. The approach is known as “microbiome-based intervention” — microbiome refers to the body’s aggregate microorganisms — and aims to enable an overall shift from a disease state in the microbiome to a healthy state. Seres Health refers to its treatments as “Ecobiotic” therapeutics. Current candidates span infectious, metabolic, and inflammatory diseases. The company was founded in 2011 within Flagship VentureLabs.

- Funding & investors: $20.5 million from Flagship Ventures, Enso Ventures, Mayo Clinic, and Alexandria Venture Investments.

- Latest news: Raised a $10 million Series B round last month.

T2 Biosystems, Lexington

- Sector: Diagnostics for infectious diseases

- Details: T2 has developed technology that provides faster and more accurate diagnosis of infectious diseases in hospitals. The diagnostics technology is part medical device, part biotechnology, and part software algorithms. T2’s first products are focused on detecting pathogens known to cause sepsis, a severe inflammatory response to infection that has a mortality rate of about 30 percent. The company has completed a clinical trial for the initial diagnostics products. Ultimately, T2 is looking at a broad set of applications that involve helping hospitals to make targeted treatment decisions earlier. The firm was founded in 2006 within Flagship VentureLabs.

- Funding & investors: $90 million from investors including Goldman Sachs, Polaris Partners, Flagship Ventures, and Flybridge Capital Partners.

- Latest news: Filed intentions this month raise up to $69 million through an initial public offering of stock.

Kyle Alspach has worked in journalism in Massachusetts since 2005 and was one of the original staff writers at BetaBoston.

Follow Kyle on Twitter